In a previous post, I wrote about how Internal Customer Experience (CX) mapping helps identify the needs of both external and internal stakeholders and is a good measure of operational health. This post takes a deeper dive into how to begin turning those insights into actions by recognizing the source of pain points.

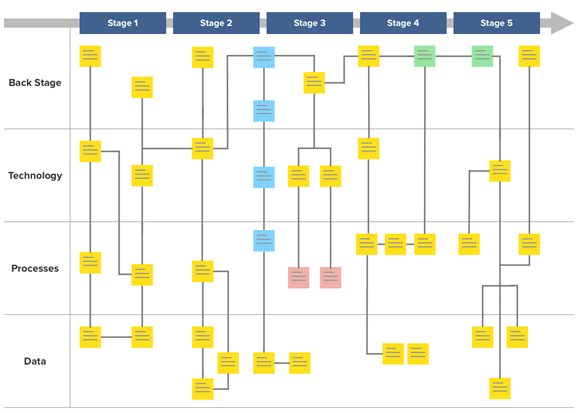

Services maps align supporting activities carried out by people, processes, technologies and data, providing a view of how a process really works. Similar to CX mapping, cross-functional representation is required to arrive at a complete view of how operations work together to drive each journey stage.

Reading the results

CX maps help to highlight drivers of customer and employee pain points. These drivers show up at the transitions between journey stages, in linear processes, and in dead ends. Let’s look at some examples:

Transition Points occur when an experience advances from one stage to the next. Services with a single point of transition tend to be time-consuming to employees and customers, who may have to wait a long time for responses. This can be resolved by making the process more proactive and transparent. When considering solutions, explore what level of information from upstream activities can be made visible downstream to “pull” the journey along.

Transition Points occur when an experience advances from one stage to the next. Services with a single point of transition tend to be time-consuming to employees and customers, who may have to wait a long time for responses. This can be resolved by making the process more proactive and transparent. When considering solutions, explore what level of information from upstream activities can be made visible downstream to “pull” the journey along. Linear Processes typically add time and can often be consolidated or further refined. These show up as sequential steps requiring a specific technology, process or person to move the journey forward. An example of a linear process would be manual preparation required to make data usable/readable to an automated system.

Linear Processes typically add time and can often be consolidated or further refined. These show up as sequential steps requiring a specific technology, process or person to move the journey forward. An example of a linear process would be manual preparation required to make data usable/readable to an automated system.

Dead-ends are tricky. They may represent an area of the experience being carried out by a third party or external source that needs to be merged back into the journey. On the other hand, they might simply be vestiges or artifacts of outdated processes that can be eliminated.

Dead-ends are tricky. They may represent an area of the experience being carried out by a third party or external source that needs to be merged back into the journey. On the other hand, they might simply be vestiges or artifacts of outdated processes that can be eliminated.

With CX and Services maps, solving pain points can unlock new revenue opportunities by introducing efficiencies that improve customer service and reduce costs – driving significant value to organizations.

Consider the Possibilities

This evolution of the retail experience offers an exciting example of how much opportunity still lies ahead for improving the customer experience in mortgage servicing. The technology is there, ready for enhancing. For example, Black Knight has been working on APIs to help technology developers seamlessly integrate with our products. This includes pushing the frontiers of artificial intelligence to increase both the speed and accuracy of data extraction. We are also working on a mobile app that would allow homeowners to get near real-time approvals on home equity loans with a simple questionnaire and six snapshots of their home taken on their camera phone.

Streamlining and Connecting

Ultimately, the goal of any mortgage servicer is to provide a positive servicing experience to their clients – both borrowers and investors. This can be done by quickly and accurately moving data through multiple processes, using technology in the service of multiple people in various key roles. How that is accomplished is still being determined, but technology will play a starring role.

Complex services, such as the processing of a mortgage payment, require the successful hand-off of data through multiple processes, using a variety of technology under the direction of multiple people in numerous roles. This needs to be accomplished at scale.

Services mapping will help to identify and prioritize pain points by surfacing bottlenecks and dead ends. By the time you are finished you should have a clear picture of linear processes, single points of transition, and legacy processes that don’t seem to have any current purpose and are being performed for reasons that are no longer relevant.