It’s long been said that to truly understand someone you need to walk a mile in their shoes. That’s the idea behind Experience Mapping, a powerful process that can be used to help unlock revenue opportunities, improve account retention and deliver exceptional customer experiences in digital servicing.

Customer experience (CX) in a servicing organization is shaped by the outcomes of all the interactions that take place around products, technologies, and communication channels including email, service reps, sales and websites, among others. A key driver of CX, and one that is often overlooked, is how the employee experience affects customer outcomes.

So why not turn an outward-facing tool like CX mapping inward and document the employee journey, to surface and eliminate pain points in the employee experience? This post provides perspective on incorporating a consumer experience mapping approach with the Business-to-Business-to-Consumer (B2B2C) world of mortgage servicing, promoting accountability through aligned goals and roadmaps that help deliver ROI.

Where to “Start”

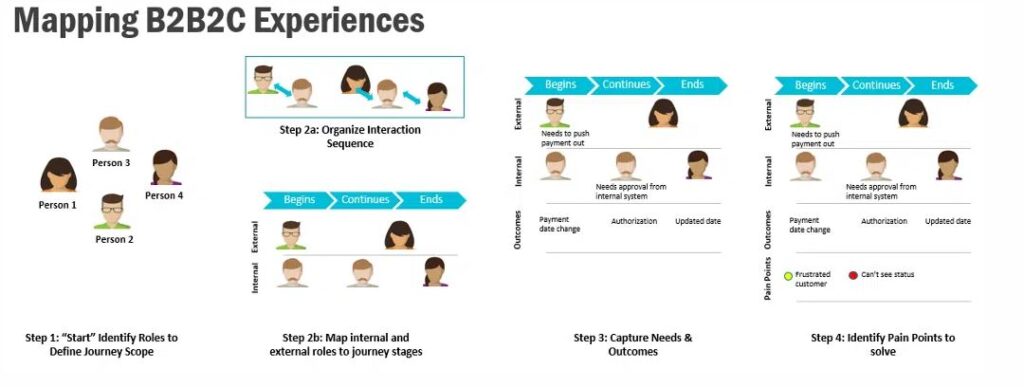

Before embarking on any journey, it is important to know where you are going. Defining the scope of an employee journey requires interviewing employees to identify challenges or obstacles in current business processes. Once priorities are identified, you can begin mapping the specific process paths, or “journeys” you want to target. Here’s what that might look like:

Step 1: Identify roles that shape the journey. These are individuals who play a direct or indirect role throughout the identified journey scope. For example, when a borrower wants to change a payment date, journey roles might include the borrower, investors, auditors, servicers and third-party processors.

Step 2: Frame the B2B2C journey. Once internal roles are identified, arrange them chronologically throughout the journey map from “Beginning” to “End” to indicate when they show up and in what context. Once the roles have been arranged, add a row for “External” roles, such as borrowers, investors and auditors, who will interact with employees in the course of the journey and whose needs and actions have a direct bearing on the employee experience.

Step 3: Capture Needs & Outcomes. This step begins recognizing needs, by role, at each stage of the journey. When a borrower initiates a date change inquiry, for example, they need confirmation from the servicer that the change is complete. The servicer, in turn, needs internal systems and processes to push the changes forward to satisfy the customer inquiry. Outcomes reflect the results of interactions within each stage of the journey and may take a variety of forms, including a triggered email, a status report, or a decision to “approve” or “deny.”

Step 4: Uncover pain points. By surfacing and eliminating pain points – friction created by broken or manual processes and other perceived hurdles (real or imagined) – journey mapping helps improve the employee experience to the ultimate benefit of the customer.

Insights to Actions

Internal CX mapping helps identify the needs of both external and internal consumers and is a good measure of the overall CX health. Solving pain points can unlock new revenue opportunities by introducing efficiencies that both improve customer service and reduce costs – driving significant value to organizations.

Many pain points can be eliminated through automation and systematic process improvement. To find out more about how Black Knight servicing technology is helping clients eliminate friction through digital servicing, contact Sandra Madigan.