Black Knight: 4.75 Million Homeowners Now in COVID-19-Related Forbearance Plans; Nearly Half Made April Mortgage Payments

- The McDash Flash suite from Black Knight leverages daily, loan-level data to provide market participants with the most current view of the forbearance and mortgage performance landscape

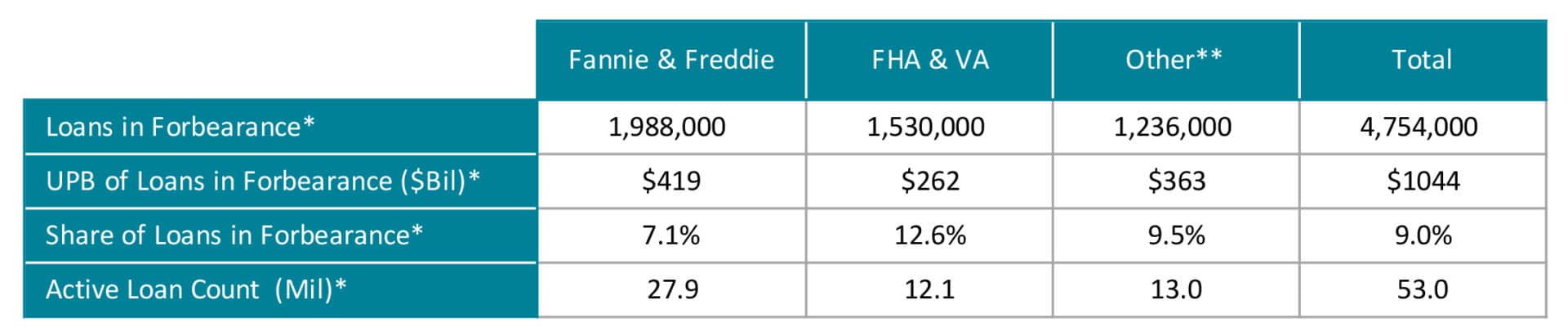

- According to the McDash Flash Forbearance Tracker, as of May 19, 2020, 4.75 million homeowners – or 9.0% of all mortgages – have entered into COVID-19 mortgage forbearance plans

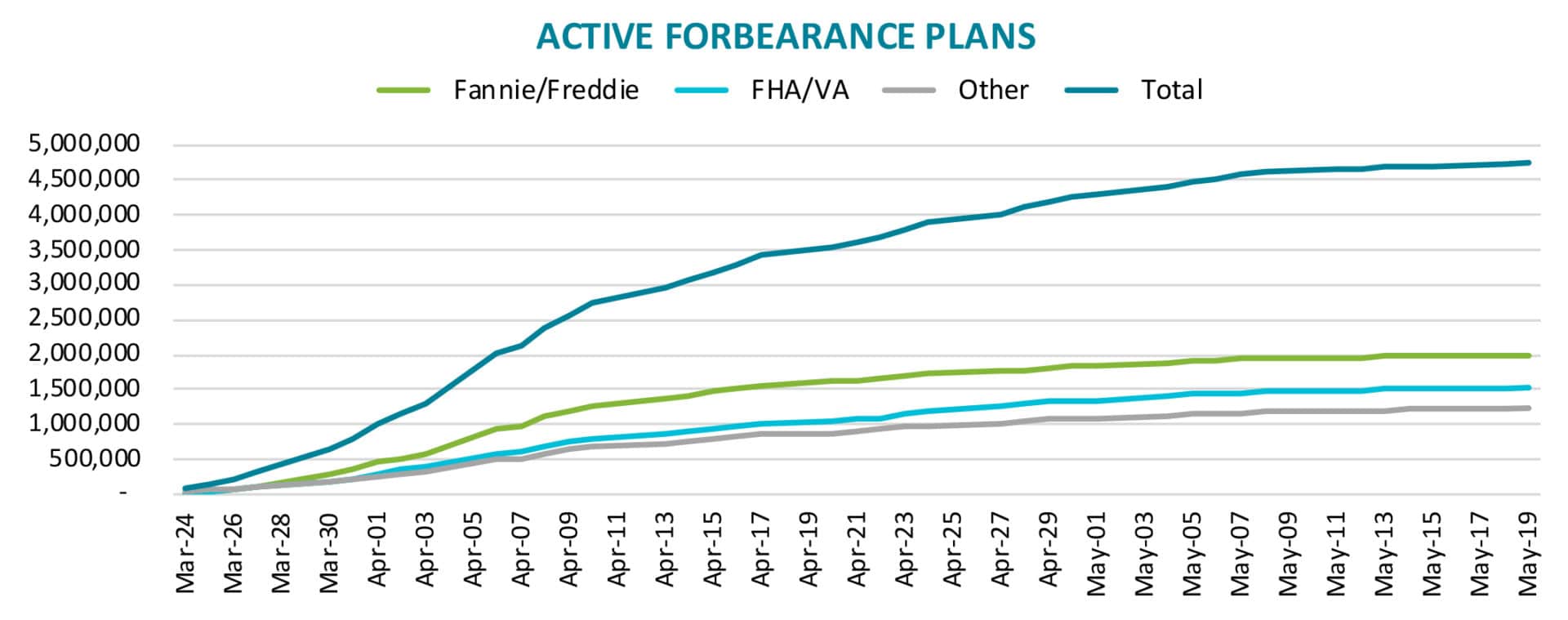

- Active forbearance volumes increased by just 93,000 over the past week, a more than 70% decline from the 325,000 from the first week of May

- The rate of increase has now declined by 93% from the first week of April when the number of active forbearance plans increased by nearly 1.4 million in a single week

- The McDash Flash Payment Tracker shows that, of the 4.25 million homeowners in forbearance at the end of April, nearly half made April’s payment, while 54% did not

- Daily mortgage performance observations through the McDash Flash Payment Tracker over the past few weeks show that as of May 19, just 21% in plans have made May payments

- Approximately, 1.4 million homeowners in forbearance who had made April payments are currently at risk of becoming past due in May, which could lead to another sharp increase in the national delinquency rate

JACKSONVILLE, Fla. – May 22, 2020 – Black Knight, Inc. (NYSE:BKI) continues to monitor the impact of the COVID-19 pandemic on the U.S. mortgage market, tracking loan-level forbearance and performance data on a daily basis through its McDash Flash data set and the new McDash Flash Payment Tracker. According to Black Knight CEO Anthony Jabbour, the increased insights made available via the McDash Flash Payment Tracker give clients insight into not only the number of borrowers entering forbearance, but daily updates on what share of borrowers are making their mortgage payments each month, whether in forbearance or not.

“Of the 4.25 million homeowners who were in active forbearance as of the end of April, nearly half – 46% – still made their April mortgage payment,” said Jabbour. “The fact that only 54% of borrowers in forbearance actually missed their payments helps explain the disparity between April’s delinquency and forbearance rates. However, just 21% of borrowers in forbearance have made their May payments, which could lead to another sharp increase in the national delinquency rate for May if those payments are not received before the end of the month.”

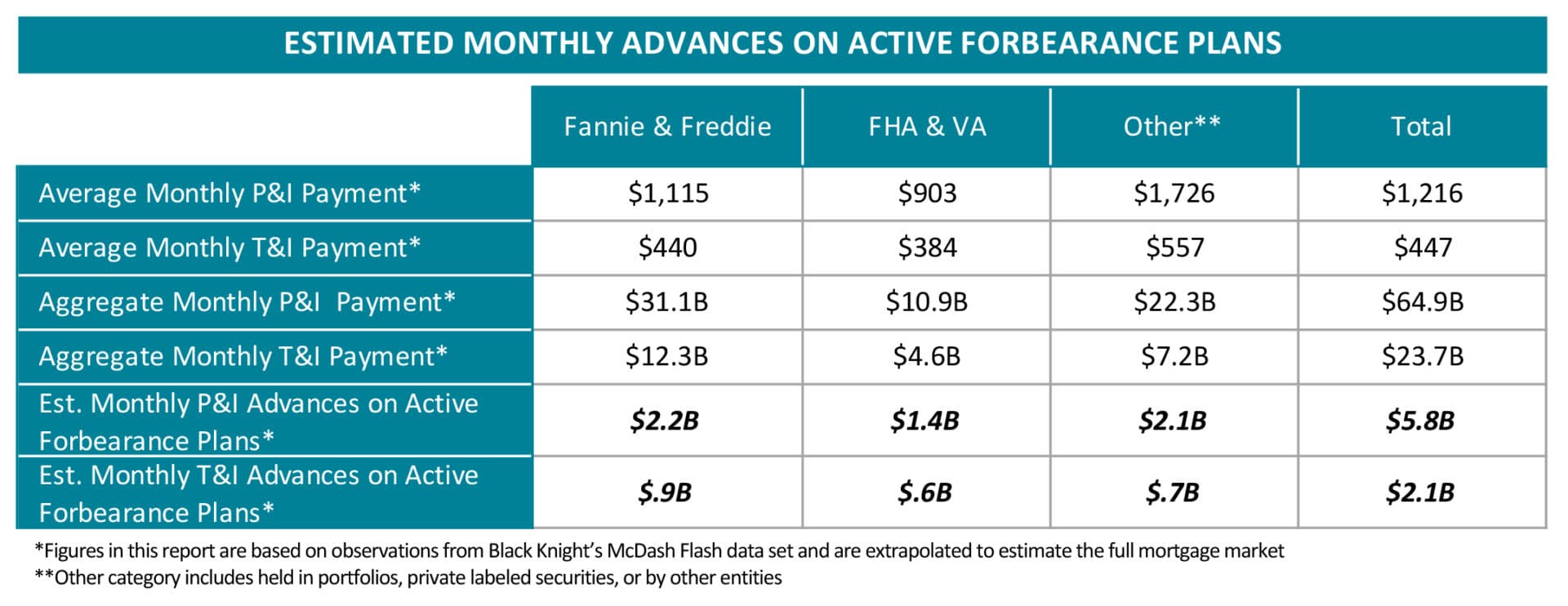

The McDash Flash Forbearance tracker shows that the 4.75 million loans in forbearance represent 9% of all active mortgages and account for a little over $1 trillion in unpaid principal. An estimated 7.1% of all GSE-backed loans and 12.6% of FHA/VA mortgages are now in forbearance. Over the past week, active forbearance volumes have increased by just 93,000, a more than 70% decline from the 325,000 in the first week of May. The rate of increase has now declined by 93% from the first week of April when the number of active forbearance plans increased by nearly 1.4 million in a single week. This slowdown suggests that volumes may be beginning to flatten, warranting a shift in servicer focus from forbearance pipeline growth to forbearance pipeline management. Black Knight’s daily McDash Flash data allows subscribers to track outstanding populations, payment activity, upcoming forbearance expirations and overall forbearance performance on a near-real-time basis.

“While it appears – at least for the time being – that the surge of forbearance requests has begun to slow, for our servicing clients, it is the beginning of an entirely new challenge,” Jabbour added. “Shifting to the management of such a large pipeline of homeowners in forbearance plans is paramount. Tools such as Black Knight’s Loss Mitigation solution, integrated with our MSP servicing system, will be essential in managing not only the forbearance period, but the millions of loan workouts and modifications that are bound to follow.”

Like McDash Primary data, McDash Flash data is anonymous and does not contain any nonpublic personal information (NPI) or personally identifiable information (PII), but can be benchmarked and/or extrapolated up for a full-market picture.

As of May 19, 2020, the McDash Flash Forbearance Tracker found the following:

About Black Knight

Moving forward, Black Knight will continue to provide weekly McDash Flash Forbearance Tracker updates via Vision, the Black Knight blog. Those interested in staying up-to-date on industry developments are encouraged to visit the blog for more information in the coming days and weeks.

About Black Knight

Black Knight (NYSE: BKI) is a leading provider of integrated software, data and analytics solutions that facilitate and automate many of the business processes across the homeownership lifecycle.

As a leading fintech, Black Knight is committed to being a premier business partner that clients rely on to achieve their strategic goals, realize greater success and better serve their customers by delivering best-in-class software, services and insights with a relentless commitment to excellence, innovation, integrity and leadership. For more information on Black Knight, please visit www.blackknightinc.com.

Forward-Looking Statements

This press release contains forward-looking statements that involve a number of risks and uncertainties. Statements that are not historical facts, including statements regarding expectations, hopes, intentions or strategies regarding the future are forward-looking statements. Forward-looking statements are based on Black Knight management’s beliefs, as well as assumptions made by, and information currently available to, them. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Black Knight undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The risks and uncertainties that forward-looking statements are subject to include, but are not limited to:

- Changes in general economic, business, regulatory and political conditions, including those resulting from pandemics such as COVID-19, particularly as they affect foreclosures and the mortgage industry;

- The outbreak of COVID-19 and measures to reduce its spread, including the effect of governmental or voluntary actions such as business shutdowns and stay-at-home orders;

- Security breaches against our information systems;

- Our ability to maintain and grow our relationships with our clients;

- Changes to the laws, rules and regulations that affect our and our clients’ businesses;

- Our ability to adapt our services to changes in technology or the marketplace or to achieve our growth strategies;

- Our ability to protect our proprietary software and information rights;

- The effect of any potential defects, development delays, installation difficulties or system failures on our business and reputation;

- Risks associated with the availability of data;

- The effects of our existing leverage on our ability to make acquisitions and invest in our business;

- Our ability to successfully integrate strategic acquisitions;

- Risks associated with our investment in Star Parent, L.P. and the operation of its indirect subsidiary, The Dun and Bradstreet Corporation; and

- Other risks and uncertainties detailed in the “Statement Regarding Forward-Looking Information,” “Risk Factors” and other sections of our Annual Report on Form 10-K for the year ended December 31, 2019 and other filings with the SEC.

Media Contacts

Mitch Cohen

704.890.8158

mitch.cohen@bkfs.com

Katia Gonzalez

678.981.3882

katia.gonzalez@ice.com