More Than 2.9 Million Homeowners Already in COVID-19-Related Forbearance Plans According to Black Knight’s McDash Flash Data Set, Represents 5.5% of All Mortgages

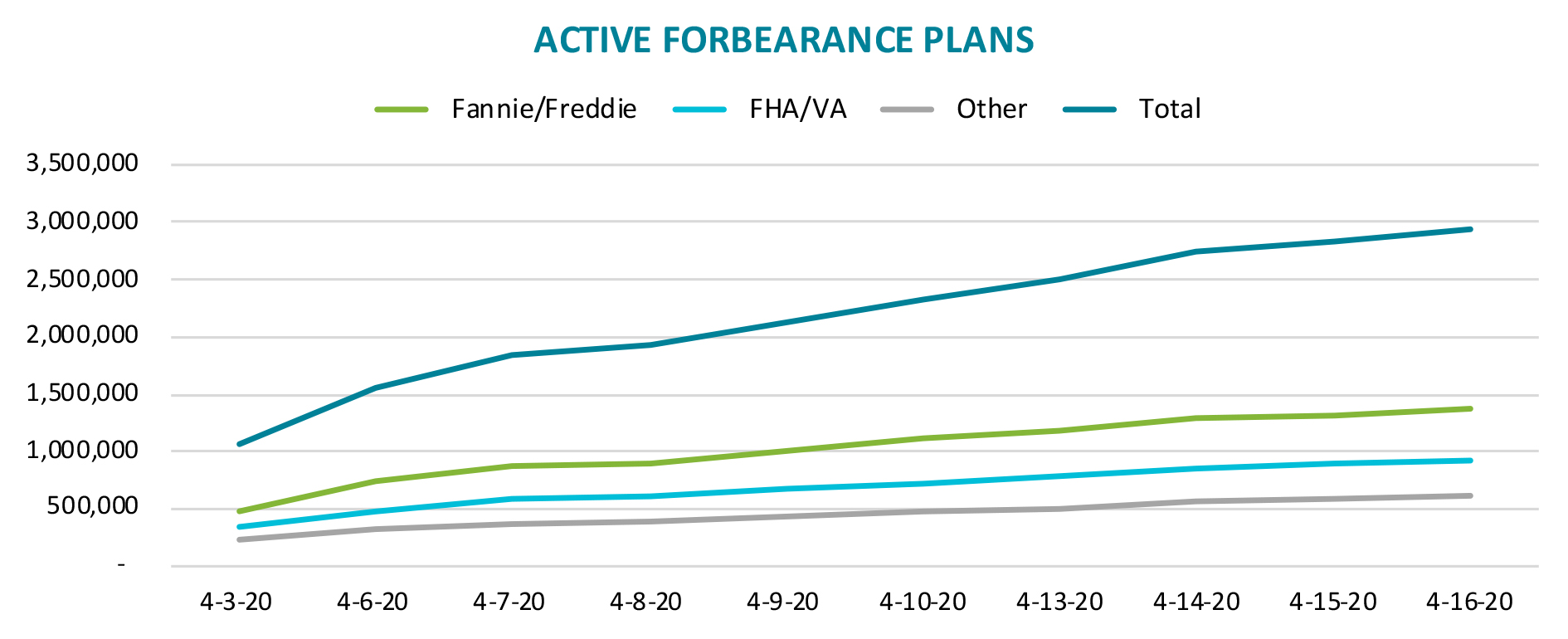

- In recognition of the severity of the situation, Black Knight has been compiling daily, loan-level information on the number of U.S. mortgage-holders seeking COVID-19-related forbearances

- Using a sample set of loans representing the majority of the mortgage market, the McDash Flash Forbearance report has been extrapolated to reflect the entirety of the active mortgage universe

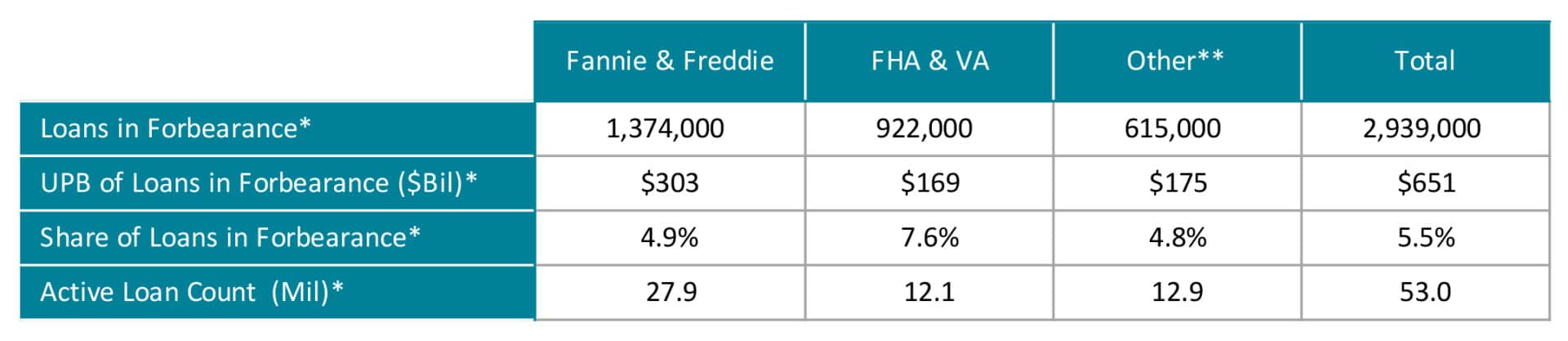

- As of April 16, more than 2.9 million homeowners – or 5.5% of all mortgages – have entered into COVID-19 mortgage forbearance plans

- This population represents $651 billion in unpaid principal and includes 4.9% of all GSE-backed loans and 7.6% of FHA/VA loans

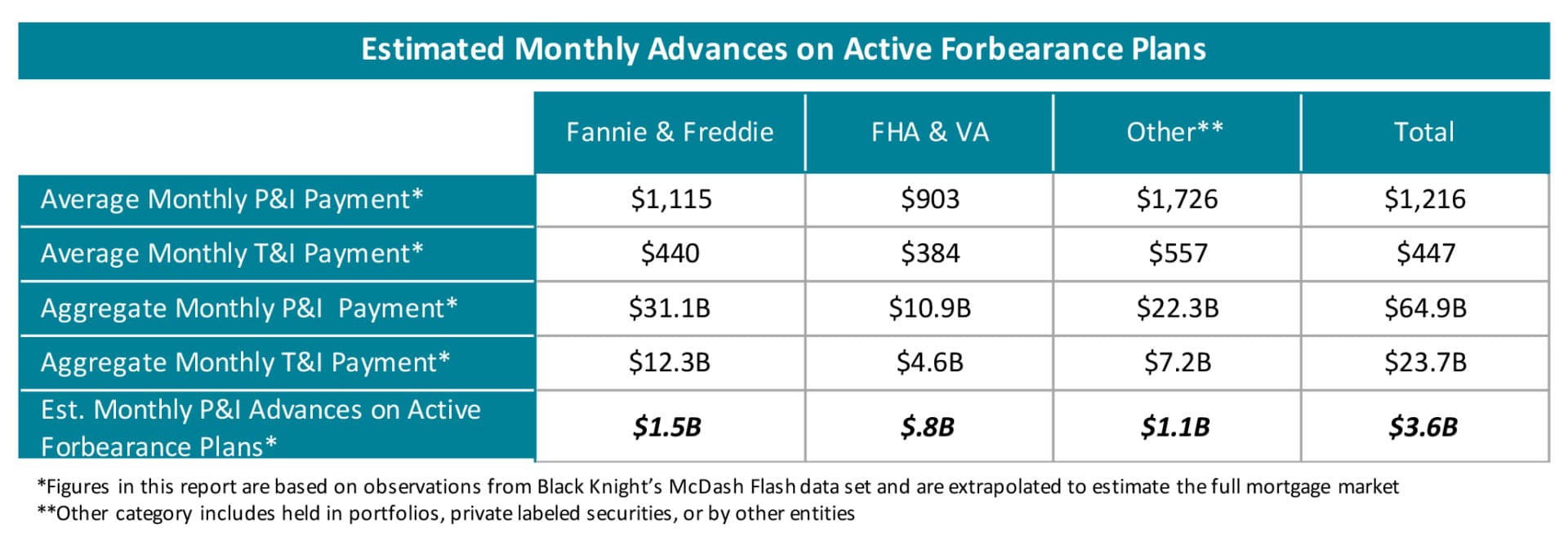

- At today’s level, mortgage servicers would be bound to advance $2.3 billion of principal and interest payments per month to holders of government-backed mortgage securities on COVID-19-related forbearances

- Another $1.1 billion per month in lost funds will be faced by those with portfolio-held or privately securitized mortgages

JACKSONVILLE, Fla. – April 17, 2020 – In light of the significant impacts the COVID-19 pandemic is having on the U.S. mortgage market, Black Knight, Inc. (NYSE:BKI) has begun tracking loan-level forbearance data on a daily basis through its newly introduced McDash Flash data set. This level of detail is essential for both mortgage market participants and government entities in addressing the economic ramifications of this crisis. Leveraging Black Knight’s extensive loan-level mortgage data and proprietary analytics, the company has created the high-level McDash Flash Forbearance Tracker report, which will be made available to all Black Knight MSP servicing clients and McDash loan-level performance data set contributors on a daily basis beginning next week. In addition, multiple government agencies and the government sponsored enterprises (GSEs) will be able to receive these updates as well. Deeper insights, including industry aggregate, custom reporting and daily loan-level performance data will also be offered.

“In these times, it is essential to both our industry and for the benefit of the entire U.S. economy to have a clear understanding of the magnitude of the mortgage forbearance situation,” said Black Knight CEO Anthony Jabbour. “Leveraging Black Knight’s extensive data, research and analytics capabilities, we are able to provide that clarity. Black Knight has the data and analytics necessary for lenders and servicers to benchmark their company’s activities against the industry and use this information to make informed decisions regarding next steps.”

McDash Flash Solutions are built leveraging daily loan-level dynamic mortgage servicing data. These solutions can be used to track forbearance, originations, late or delayed payments, delinquency, foreclosure, loss mitigation workouts, as well as voluntary and involuntary runoff. Like McDash Primary data, McDash Flash data is anonymous and does not contain any nonpublic personal information (NPI) or personally identifiable information (PII). For contributing servicers, however, McDash Flash data can be benchmarked and/or extrapolated for a full market picture.

As of April 16, 2020, the McDash Flash Forbearance Tracker found the following:

Much more detail on the impact of COVID-19 on the mortgage and real estate industries, as well as challenges and solutions relevant to individual market segments, can be found in Black Knight’s special white paper, available to download for free at this link. Black Knight will continue to provide weekly McDash Flash Forbearance Tracker updates via Vision, the Black Knight blog. Those interested in staying up-to-date on industry developments are encouraged to visit the blog for more information in the coming days and weeks.

About Black Knight

Black Knight (NYSE: BKI) is a leading provider of integrated software, data and analytics solutions that facilitate and automate many of the business processes across the homeownership lifecycle.

As a leading fintech, Black Knight is committed to being a premier business partner that clients rely on to achieve their strategic goals, realize greater success and better serve their customers by delivering best-in-class software, services and insights with a relentless commitment to excellence, innovation, integrity and leadership. For more information on Black Knight, please visit www.blackknightinc.com.

Media Contacts

Mitch Cohen

704.890.8158

mitch.cohen@bkfs.com

Katia Gonzalez

678.981.3882

katia.gonzalez@ice.com